Is Pet Insurance Worth It

Vet medical bills for injuries and illnesses can be very costly, and pet insurance can be a good way to cover some of these costs.

For example, if your dog ruptured his ACL, surgery could cost thousands of dollars. Lets suppose the total cost for surgery is $3,000 and you have coverage with a $500 deductible and 90% reimbursement level. In this scenario, your out-of-pocket cost would be $750 .

Some pet owners prefer to set aside money in a savings account for a pets medical needs. But if you cant afford a surprise vet bill that could be thousands of dollars, pet insurance is a way to guard against racking up a credit card bill or finding another way to pay.

Is It Worth Getting Pet Insurance For Your Dog

Every pet owner should consider pet insurance. Even if you believe you have enough money to cover veterinary costs, pet insurance could still save you thousands of dollars if your pet gets sick or injured. Especially if you have multiple pets, your out-of-pocket costs could add up considerably without insurance.

What Is The Most Popular Pet Insurance Provider

Popularity might be indicated by a pet insurers number of customers, positive customer reviews and national availability, all of which were included, at least indirectly, in how we judged insurance companies for this review. It would be oversimplifying, however, to say that our top-rated pet insurer is also the most popular.

The better way to think about pet insurance providers is to ask which companies cater to you and your pet best. Our methodology should at least narrow down the contenders, but its wise to consider factors like your budget and your pets age, breed and medical history before choosing one insurer over another.

Read Also: Fussy Cat Dry Cat Food

Does Pet Insurance Cover Prescription Medications

Most standard pet insurance policies provide partial reimbursement for the cost of prescription medicine required as treatment for an illness or injury. That can exclude items such as prescription pet food recommended by veterinarians to treat a chronic gastrointestinal condition or food allergy. Adding a wellness plan to your pet insurance coverage will generally give you coverage on routine medications such as flea and tick prevention.

Best For: A Short Simple Waiting Period

You may know the American Society for the Prevention of Cruelty to Animals for its animal shelters, but it also offers solid pet insurance plans through its insurance partners. Coverage includes things some other companies exclude, such as prescription food to treat a covered condition, holistic treatments and behavioral therapy.

Other perks: Medical records or vet exams arent required for enrollment, and the waiting period for accidents, illnesses and cruciate ligament injuries is just 14 days. Theres a 10% discount for multiple pets.

Animals covered: Cats, dogs and horses.

States available: All 50 states and Washington, D.C.

Age restrictions: 8 weeks is the minimum age. Theres no upper age limit.

Deductible options: $100, $250 or $500 per year.

Reimbursement options: 70%, 80% or 90%.

Coverage limits: Annual limits range from $5,000 to unlimited.

Accident-only plan available? Yes.

-

Covers horses in addition to cats and dogs.

-

Shorter waiting period than most plans for cruciate injuries .

-

Standard plans cover alternative therapies, behavioral issues and congenital conditions.

Cons:

-

You must call rather than getting an online quote if youre interested in unlimited annual coverage.

Recommended Reading: Is Purina Kitten Chow Good

Best Pet Insurance For Cats

As members of the family, our cats deserve the best quality of life we can provide for them. Aside from giving them love and affection, looking out for their health is of utmost importance. The best way to do so is by regularly taking them to their veterinarian for routine check-ups.

However, even with our best intentions, cats can suffer accidents or illnesses that require emergency visits to the vet. Sometimes these incidents call for costly treatments, procedures, and medications that, gradually, can become a huge financial burden for pet owners.

Thankfully, pet insurance for cats has become a reasonable alternative to out-of-pocket, high costs for veterinary care. Many companies now offer coverage thats broad, affordable, and accepted by most service providers.

But what does pet insurance cover? How much does it cost? How do you choose among so many options? Before looking at the top companies that provide pet insurance for cats, lets go over some pet insurance basics.

Best Pet Insurance For Cats: Spot

Waiting period:

14 days , 180 days

Spot is the top provider hereand offers the best pet insurance for older cats in particular. The company allows you to insure cats as young as 8 weeks and as old as 20 years. Plus, the monthly premiums dont skyrocket for older cats the way they do for older-pet policies advertised by competitors.

We also like that Spot, like ASPCA, makes it easier than most competitors to customize your policy and opt for accident-only coverage if you have a courageous cat who likes to tour your neighborhood. Other perks of insuring your cat with Spot include its 30-day, money-back guarantee .

That said, if youre seeking the best cat insurance for your feline, its wise to compare options with ASPCA and other providers before signing on the dotted line.

Also Check: Purina Friskies Prime Filets Cat Food

What Does Cat Insurance Typically Include

Policy inclusions can differ significantly between insurers, particularly in terms of what is automatically included and what must be selected as an extra. Some coverage options are only available in premium policies, while others may either be an optional extra, or minimally covered in basic policies, with increased coverage amounts as part of a premium policy.

As a general guide, in addition to covering veterinary treatment for accidents and/or illnesses, cat or pet insurance covers:

What Is Lifetime Cover

With pet insurance, a Lifetime Cover policy is one in which the treatment of a condition will be covered for as long as necessary. While lifetime insurance or lifetime policies are still limited regarding annual maximum claim spends, they will reset each year to provide long-term care for ongoing conditions.

Conversely, without lifetime cover, claimable conditions are only covered up to a set amount and only for 12 months from the first related claim being lodged.

Recommended Reading: Iams Or Purina Cat Food

Does Pet Insurance Cover Pre

Some policies exclude cover for older cats, while others only cover healthy pets and not cats that already suffer from one or more pre-existing medical conditions. Standard pet insurance may also not cover cats used for breeding.

If your pet falls into one of the above categories, you could still insure them through a specialist pet plan.

Heres more information on how to claim on your cat insurance, including all the common exclusions to look out for.

How Did Pets Best Win Best Overall

Recommended Reading: Purina Pro Plan Cat Food Chicken And Rice

What Do Wellness Plans Cover

Wellness coverage is purchased as an add-on or a standalone product and covers things that typically take place during an annual exam, such as vaccination, flea/tick/heartworm treatment, teeth cleaning, and spay/neuter procedures. These plans are available to cover the costs associated with preventative measures that assist in your dogs overall health and prevent illnesses where possible. Regular vet visits, especially ones that are covered, also encourage owners to be more proactive with their pets health. Wellness plans are not pet insurance as they dont cover accidents or illnesses.

What Does Cat Insurance Cover

Cat insurance covers veterinary expenses for your cat throughout their life. The coverage details are unique to the insurance policy and provider you choose.

Comprehensive cat insurance plans help with costs throughout your cats life. These plans have varying coverage offerings for vaccinations, routine care, and even spay/neuter procedures.

Other cat insurance plans are just accident or emergency-based as a backup plan if an accident happens for example, your cat ingests something and needs emergency care. Emergency vet costs are expensive, so cat insurance is a plan for the unforeseen.

Recommended Reading: Costco Wet Cat Food Price

Latest News On Pet Insurance

Pet insurance is just one of many expenses to consider when getting a new pet. What about the non-negotiables like food, vet care and household items? How to Budget for a New Dog can help you organize your finances, so you know what to expect as initial and recurrent pet care expenses start to line up.

Discount hunting and comparison shopping takes time so its best to know which expenses are worth the effort and which arent. 5 Smart Ways to Save Money on Your Pets identifies areas where you can actually save a little such as medications, wellness plans and off-brand products.

The food section at a local pet store much like your grocery stores cereal aisle may induce a sort of choice overload. There are just too many options: dry food, wet food, grain-free, affordable, expensive the list goes on. Our Best Dog Food and Best Cat Food reviews can help simplify the choice.

Sniffspot a service that connects landowners with pet parents that want extra space for their dog to run in is a way to make extra money and meet all sorts of dogs. Check out Got a Backyard? You Can Make Thousands a Month by Letting Dogs Come Play in It, where we interview the founder and explain how exactly Sniffspot works.

Dont Underestimate The Importance Of Good Customer Service

A sick cat is stressful enough and, supposedly, your insurance provider exists to give you peace of mind. Believe it or not, a phone call with your insurance provider shouldnt leave you ripping up loose papers on your desk or muttering expletives to the tune of never-ending hold music.

Test a prospective providers customer service by giving them a test run ask questions through the websites chat feature, call their customer support line, and check for 24/7 support. Remember that most customers wont hesitate to let the world know about their experience, so read customer reviews to learn how the company treats policyholders.

If you spot numerous reviews complaining about a disappointing customer support team, vague policy information, unreliable reimbursement, and soaring premiums, you can assume this pet insurance provider will cause more headaches than it solves.

You May Like: What Kind Of Cat Does Justin Bieber Have

Compare Our Top Cat Insurance Providers

| Insurer |

|---|

- Supplements or prescription food

- Behavioral therapy

As a cat owner youve likely found that the most common costs you have for your animals, particularly kittens, is their routine exams. While some insurers, such as Pets Best, cover exam costs, others do not. With some insurers, you may have to opt for a more expensive monthly premium to get them included. While such preventative treatment is a common expense, its worthwhile to do the math and see if it actually saves you any money. The money you have to add to your monthly premium may be more than your out-of-pocket cost for 1 or 2 annual checkups, depending on the insurance provider and its fees.

It is very rare for any pet insurance provider to cover pre-existing conditions. However, some providers, such as ASPCA, will cover conditions that have been cured and have shown no symptoms for at least 180 days.

If your pet is part of a breed that has a greater risk for a particular medical issue, youll want to make sure that you choose a provider, such as Embrace, that covers breed-specific and genetic conditions. If you have a purebred cat, research the breed to see if there are any conditions you should know about.

Top 7 Cat Insurance Providers Reviewed

When it comes to cat insurance policies, there is no such thing as one size fits all. Each pet insurance policy offers a varying degree of coverage, excess options, extras and more. The following seven pet insurance companies were chosen based on how frequently they feature on top UK pet insurance provider lists across a wide range of reputable sites.

Given these variations, no two pet insurance policies can be accurately compared on a like-for-like basis, but of the seven we reviewed, there are some honourable mentions:

Don’t Miss: Food For Kittens With Diarrhea

Create A Custom Comparison Chart The Smart Way

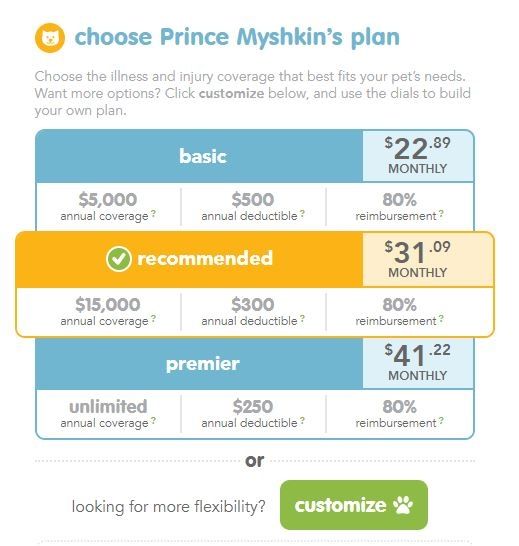

After talking to many pet parents, it’s clear that people wanted a solution to quickly and easily compare their recommended plan and other interesting options from within a comparison chart.

This makes a lot of sense. There’s just so much information to digest, the easiest way to simplify the comparison process to view plans sided by side – highlighting key differences in pricing and coverage.

So we upgraded the Pawlicy Advisor tool to help pet parents generate custom comparison charts on the fly.

Here’s an example comparing a Pets Best plan to an ASPCA option:

The above screenshot is just a fraction of what Pawlicy Advisor’ comparison charts show.

In total, you’ll be able to compare the following policy details side-by-side: costs, illnesses, cancer, accidents, breed-specific conditions, dental, alternative therapies, behavioral issues, prescribed foods and medications, exam fees, poison consultation, supplements, stem cell therapy, LASER therapy, lost pet advertising, cremation or burial, and more.

Other Pet Insurance Comparison Factors

Here are two more factors to consider when buying a pet insurance plan:

- Exam fees. When you take your pet to the veterinarian for an accident or illness, you pay an exam fee, costing $100 or more depending on your veterinarian and visit type. Make sure the policy covers these exam fees because not all do.

- Benefits. Look for extra benefits like a 24-hour vet helpline in case your pet gets sick at night. As another example, Nationwide pet insurance members have access to preferred pricing on pet prescriptions at any Walmart pharmacy.

Read Also: How Are Male Cats Neutered

Understanding Premium Pet Insurance

How it works: Best for:What you need to know:

- These policies cost the most and they offer the most comprehensive cover with $15,000-$20,000 in annual cover, although you may still pay excesses on each claim .

- You can claim as much as you want up to the limit, and after 12 months the fixed sum resets. Your policy may however increase if your pet is seen as high risk.

Who Is Cat Insurance For

Everyone! The cost of veterinary care can be expensive. Vet bills can add up quickly, especially as your cat ages or if they have a chronic illness.

The cost of treatment and follow-up care can be a financial burden on you and your family. Cat insurance will lessen the blow of an unexpected accident or a long-term medical condition.

Cat health insurance is a protection in case of emergency. It is promising to give your cat the best care for its life.

Don’t Miss: Homemade Maine Coon Cat Food

Understanding Medium Pet Insurance

How it Works: Best for: What you need to know:

- These policies are similar to the basic policy, with a higher cap on vet bills and similar excesses on a claim .

- You can claim as much as you want up to the limit, and after 12 months the fixed sum resets. Your policy may however increase if your pet is seen as high risk.

Figo Pet Insurance: Most Flexible Reimbursement Rates

While most companies limit the amount of a vet bill they reimburse to 90%, Figo has a total reimbursement option of 100%. The provider also offers unlimited annual benefits and a range of useful add-ons to make your plan truly comprehensive, such as liability coverage for damages or injuries your pet causes.

Recommended Reading: How Many Days Can A Cat Go Without Food

Types Of Pet Insurance Plans

When youre looking to insure your pet, the first thing to do is take a good look at your finances and how much youre able and willing to spend in case of an emergency. Pet insurance policies vary in their coverage and, of course, premiums. Understanding the various types of policy, and what each offers, is crucial for understanding how to buy pet insurance.

- Accident-only policies An accident-only plan may suit you best if your main concern is your cat or dogs propensity for mishaps . Theyre usually more affordable than plans with more expansive coverage.

- Accident & Illness policies These are the all-inclusive pet insurance plans, covering both accident and illness coverage. They can be expanded to be truly comprehensive by buying wellness coverage, which is usually an add-on rather than an integrated part of the plan.

- Comprehensive policies Some insurers offer comprehensive policies covering everything, from accidents to illnesses to wellness and routine care. For example, they may cover the cost of dental care, chiropractic care, spaying, vaccinations, behavioral therapy, and more. Naturally, these plans have the heftiest price tag but might be worth it to you for the peace of mind they provide.

If you want to evaluate whether an insurer is right for you, its a good idea to download its sample policy, which is usually available on the company website.