How To Choose The Best Pet Insurance For You

Pet insurance coverage varies per state and policy terms may change annually. As policies are not a one-size-fits-all, NAPHIAs guidelines to choose the best policy suggest that you:

- Consider what your pet needs over its lifetime, whether in general or breed-specific

- Pick coverage levels suitable for common procedures and breed-specific conditions

- Set benefit limits that align with the average cost of treatment in your area

- Look for the shortest waiting periods

- Take a close look at policy terms on chronic, hereditary and pre-existing conditions

- Compare costs: premiums, copayment and reimbursement percentages

Dont forget to apply any available discounts to reduce your monthly payment. Common discounts include:

- Multipet discount discounted rates for each additional pet you enroll with the same provider

- Annual pay discount lower rates if you pay for the policy annually instead of monthly

- Spay/neuter discount reduced premium if you spay/neuter your pet upon enrollment

- Military discounts discounts for active and former members of the armed forces

- Group discounts at work lower rates for employer-provided pet insurance

- Bundle discounts discounted rate for bundling with homeowners or renters insurance under the same provider

What Is A Waiting Period

When you enroll your pet in a new insurance policy, there are more considerations aside from just the type of coverage, pricing, and deductibles.

Once you have enrolled, there is a waiting period that is generally from 14 days to 30 days depending on the pet insurance company.

It is during this time that the pet insurance provider makes sure that your pet doesnt have any illness or condition that you didnt disclose.

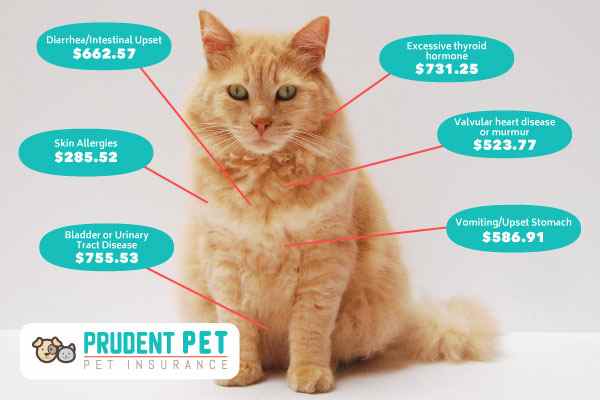

The Cost Of Medical Emergencies

Unforeseen emergency veterinary care is almost impossible to predict – and all too common. In fact, 1 in 3 pets will need emergency treatment within a given year.

Accidents like dog bites, fractures, and object ingestion can cost thousands of dollars to treat. A ligament repair in dogs can cost $3,000 to $7,000, not including X-rays, anesthesia, and follow-up care .

For cats, a urinary obstruction often requires lab testing, antibiotics, and even surgery, which can cost up to $3,000.

At the very least, the average cost for unexpected veterinary care can range anywhere from $800 to $1,500 or more.

Considering 69% of Americans have less than $1,000 in savings to spend in an emergency, its troubling to think what could happen to a family if they are suddenly overwhelmed with thousands of dollars in veterinary expenses.

In the worst cases, a pet medical emergency can lead to long-term expenses.

When this happens, not only do you need to cover the cost of your visit to the emergency vet, but you also have to factor in long-term costs to your yearly budget.

If your pet is seriously injured or develops a chronic illness, they may need regular treatment and medications to maintain their quality of life.

Don’t Miss: Gargamel Cat Name

Prudent Pet Plans And Coverage

Prudent Pet offers three pet insurance plans and two add-ons to give pet owners more coverage options. The Accident-Only Plan covers $10,000 per year for procedures or vet visits related to accidents or injuries, such as bite wounds, swallowed objects, and broken bones. The Essential Plan covers $10,000 per year for those accidents in addition to illnesses such as cancer, birth defects, digestive illnesses, hip dysplasia, and hereditary conditions.

The Ultimate Plan covers unlimited vet bills for the accidents and illnesses in the Essential Plan, plus coverage for lost pet advertising, boarding fees, pet replacement during a theft or loss, mortality expenses, and vacation cancellations. None of these plans cover pre-existing conditions that arise before or during your policy enrollment or waiting periods.

Additionally, Prudent Pet offers a wellness coverage add-on that can be an extra $7.95, $13.95, or $19.95 per month depending on how many preventative benefits and coverage limits you need. For even more coverage, Prudent Pet sells an add-on for veterinary exam and consultation fees.

What Are The Alternatives

Most pet owners do not adequately prepare for veterinary care when they adopt their pet, which is understandable. Who wants to think about the vet budget when theyre about to welcome a new member of the family?

Families who are too eager to introduce a pet into their lives are often tempted to adopt first and worry about expenses later.

Of course, this leads to challenges at the vet later on.

One fellow veterinarian said he has 5 to 10 difficult discussions per day with pet owners who cannot afford the cost of their animals care.

Insurance executives and veterinarians frequently say the average amount a pet owner can afford at the veterinary office for a one-time expense is approximately $1,500.

The alternative to paying for necessary care is putting your animal up for adoption, or in worse-case scenarios…euthanization. This is obviously distressing for everyone involved.

These dilemmas can and should be avoided.

As a pet owner, you only have a few financial options for covering the cost of veterinary care if you are paying out of pocket.

Read Also: Liquamycin La 200 For Cats

A Should I Get Pet Insurance Decision Tree

- If you have a healthy puppy or kitten… I would get pet insurance.

- If your puppy/kitten has a pre-existing condition… pet insurance may still be worth getting to cover any new issues that may appear later in your pet’s life.

- If you have a healthy mid-age dog or cat… I would get pet insurance before any health issues arise.

- If your dog/cat has a pre-existing condition… pet insurance may still be worth it if your pet is on the younger side or at risk of other health issues.

- If you have a healthy senior dog or cat… I would consider pet insurance. 50% of dogs over the age of 10 develop cancer, so if your pet is a healthy senior, pet insurance could add a layer of protection should they need cancer treatment.

- If your senior dog/cat has a pre-existing condition… pet insurance is probably not a good fit. Instead, I would stay on top of preventative care and maybe increase routine vet visits, while maximizing a pet health savings account.

What Is Covered By Pet Insurance

Unlike health insurance for humans, pet insurance doesnt cover preventative care, such as routine exams, dental work, or vaccinations. Buying pet insurance makes sense only for the things you cant predict, like ear infections, broken bones, and chronic illnesses.

For wellness care, including annual checkups and booster shots, youre better served by setting aside money each month, rather than going for a more-expansive insurance policy that may cover those things. Some companies do offer wellness benefits, but the higher costs of those plans can offset any savings. And if you miss a checkup, you forfeit the services youve already paid for .

Insurance plans also exclude preexisting conditions, as well as treatment for animals suffering from abuse or neglect, including for preventable diseases if an owner skipped the vaccine for that disease. So if your dog gets Bordetella , and you didnt keep the Bordetella shot up to date, insurers wont cover the cost of treatment. If you really dig into the fine print, youll find a range of other exclusions, such as the effects of war, radiation from nuclear weapons, biological attacks, mutant flu, and zombie outbreak.

Recommended Reading: Cat Urine Stain On Hardwood Floor

How Much Does Pet Insurance Cost

Pet insurance premiums vary depending on the coverage that you purchase and the benefits of the policy. Typically, the higher the premiums paid, the more expansive your coverage is. An emergency-only policy is just $24 per month with Pawp, while more robust policies start at just $1 per day with GEICO Pet Insurance. As with other types of insurance, when you increase the deductible or qualify for discounts, your premiums can be reduced.

Pet Insurance A Thriving Industry Abroad Is Also Beginning To Take Off In India Given The Rising Cost Of Purchase Grooming And Medical Care For Pets It May Be Time To Cover The Risks Read To Know What Is On Offer What The Costs Look Like And What Is Included

coverpetpet insuranceinsuranceWhat is covered?Pet covers onofferWhat is the cost?

Bajaj Allianz has capped the cover size for surgery at Rs 50,000, for hospitalisation at Rs 10,000, while its third-party liability cover has two options: Rs 5 lakh and Rs 10 lakh. Pawtect, on the other hand, has fixed covers of Rs 40,000, Rs 60,000, Rs 1 lakh and Rs 1.5 lakh Bajaj Allianz New India Assurance Oriental Insurance Vetina Pawtect and one can choose from Red, Yellow and Blue Ribbon plans. The premium is determined by the breed, age, size and even gender of the dog. For New India, it is fixed at 5% of the sum insured, and for Oriental at 6% of the cover. You can get quotes from these insurers at www.bajajallianz.com/pet-dog-insurance. html and www.pawtectindia.com/, and can download application form for New India Assurance at www.newindia.co.in/portal/product/knowMore/RURAL/DG.

Exclusions & limitations

Read More News on

All you need to know about ITR filing for FY 2020-21.)

Read Also: Cat Urine Stains On Hardwood Floors

Best For Accident & Illness Only: Healthy Paws Pet Insurance

Our choice for the best accident and illness coverage is Healthy Paws. You can choose any vet or emergency clinic that you like rather than being restricted to in-network vets. There are no limits on claims with no per-incident, annual, or lifetime caps on payouts. And it offers quick reimbursement of vet bills with 99% of claims paid within two days.

Healthy Paws policies cover accidents, illnesses, cancer, emergency care, genetic condition, and alternative care. Policies start at $15 per month for cats and $20 per month for dogs. This low price does mean that its policies do not cover preventative care, vaccinations, or dental exams. Additionally, age restrictions do apply for pets older than 8 years old and pets 6 years and older must have a physical exam prior to approval. For every pet insurance quote, Healthy Paws makes a donation to a homeless pet’s medical care.

Best For New Pet Owners: Aspca Pet Health Insurance

ASPCA Pet Health Insurance scored an 89 out of 100 in our review of the top pet insurance providers. It features a local vet finder tool on its website and mobile app, a breadth of articles and resources about various animal breeds and their common health conditions, and a useful pet insurance comparison tool.

Get a free quote from ASPCA Pet Health Insurance by visiting the providers website.

Also Check: How To Make Animals In Little Alchemy

Pet Insurance Vs Dog Life Insurance: Which Do I Need

Pet insurance is designed to help you more easily afford the high costs of veterinarian care for your dog, cat, or other pet. It is possible to get dog life insurance which is a life insurance policy that pays a benefit when your dog passes away. Though expensive and often reserved for working dogs, dog life insurance helps pay for the costs associated with your dog dying. Costs may include cremation or burial as well as a service if you choose to have one.

Best Pet Insurance In Massachusetts

Getting a pet insurance quote is a similar process to get a quote for auto insurance or life insurance. The one main difference deals with payments. Unlike human health insurance, you will pay the vet bill upfront and then wait to be reimbursed by your pet insurance provider.

There are many pet insurance companies to choose from including Nationwide, Trupanion, Healthy Paws, and PetsBest to name a few. Weve analyzed over 30 different companies, but narrowed down.

Here are the 5 best companies that provide pet insurance in MA:

You May Like: Does Cat Noir Figure Out Who Ladybug Is

Select A Plan That Reimburses A Percentage Of The Actual Vets Bill Not A Standard Charge

Pet insurance differs from traditional health insurance in that the plan generally reimburses you for a percentage of the final bill. You have to pay the bill yourself upfront, but then you can file a claim to receive between 70% and 90% of covered costs. There generally isnt a co-pay.

Instead of a percentage, some insurance providers base their reimbursements on usual and customary charges. Insurance providers calculate these rates based on national surveys, internal data, and knowledge of your area.

These usual and customary charges are not appropriate for a real-world billing scenario. Instead, choose a reimbursement plan based on the care your cat receives in reality.

What About Cat Insurance For Older Cats

Cat insurance coverage can be especially beneficial for older cats since they may need more veterinary care as they age. Senior cats can be at a greater risk for health conditions, such as arthritis, diabetes, and cancer. They can also be prone to getting hurt, especially if theyre dealing with mobility issues or cognitive decline. Just keep in mind that most plans wont cover pre-existing conditions.

Don’t Miss: Sifting Cat Litter

Best For Routine Care: Petfirst

- Coverage types: Accident and illness, preventative

- Starting price: $125 per year

- Deductible: $250

PetFirsts wellness rider gives the best value for routine care with flexible benefits that can be tailored to your average annual expenditure.

-

Wellness benefits available from $125 to $575 annually

-

Deductible of just $250

-

Accident coverage begins the day after enrollment

-

Online resource center

-

Each preventive treatment has its own individual limit

-

Accident and injury limits max out at $10,000 per year

-

Doesnt offer an accident-only plan

PetFirst offers a single insurance policy that provides coverage for pet injuries, illnesses, and related treatments, including:

- Hospitalizations

- Alternative therapies

- Emergency care

You can begin using the accident coverage just one day after your enrollment begins, but you have to wait 14 days before using the coverage for illnesses.

Pet owners also have the option to add PetFirsts Routine Rider Coverage, which pays for the cost of your pets annual vet exam, vaccines, behavioral training, microchipping, and more. This rider is available in five tiers, with $125 to $575 in annual coverage.

PetFirsts accident and injury pet insurance plan has a fixed deductible of $250. You can get a personalized insurance quote through the website, but these are the starting premiums for accident and illness coverage:

- Dog insurance: $15 per month

- Cat insurance: $9 per month

When You Should Get Pet Insurance

The younger your pet is when you enroll them, the more valuable insurance will bebut that doesnt mean you shouldnt enroll an older animal or one with hereditary conditions. Even though wellness visitsthe most common costs for young petsarent covered by most insurance plans, the lower premiums at younger ages likely make starting early worthwhile. Its also good to establish a policy as soon as possible, since establishing new coverage is often far more expensive than continuing an existing plan. Although we no longer can offer picks in this guide, representatives from our former pick Trupanion told us that since 2012, premiums had increased roughly 6% per year across all of the pets the company covers. And they said the company expects rates to climb 5% to 6% per policy year going forward. However, in 2017, our fictitious cat cost an average of $52 per month to insure. In 2021, establishing coverage for a new pet cost $143 a montha 275% increase. Such a jump is a reminder that insuring your pet sooner rather than later will save you money.

An example of lifetime premium costs

| Age at enrollment |

|---|

| Yes, with the BestBenefit Accident and Illness Plan | |

| Trupanion | Yes |

Also Check: Why Was Cat From Victorious So Crazy

Compare Pet Insurance Providers

| PetFirstBest for Routine Care | Accident, Illness, Wellness | |

| ASPCABest for Multiple Pets | Accident, Illness | |

| FigoBest for Holistic Care | Accident, Illness | |

| HartvilleBest for Older Dogs | Accident, Illness | |

| 24PetWatchBest for Chronic Conditions | Accident, Illness | |

| USAABest for Service Members | Accident, Illness, Wellness | |

| ProgressiveBest Affordable Pet Insurance | Accident, Illness, Wellness | Unlimited |

Cat Insurance: Compare Pet Insurance Providers Policies & More

Writer Mary Anne Radmacher says, Unexpected events can set you back or set you up–its all a matter of perspective.

At Pet Insurance Review, we want to make sure you dont get set back when your cat unexpectedly gets sick or injured. Cat insurance provides invaluable peace of mind that your pet is protected should the unexpected happen, regardless of your financial situation.

Also Check: Translate Cat In Spanish

Pet Insurance In Plain English

The language used by pet insurance providers can be confusing, which sometimes makes it tricky to figure out what youre really getting in a plan.

Be in the know about coverage terms and conditions with this quick language guide.

- Visit any vet, specialist, or emergency clinic you like & pay your bill.

- Submit claims your way – online, by mail, or by fax.

- Have reimbursements directly deposited into your bank account or mailed.

*Pre-existing conditions are not covered. Waiting periods, annual deductible, co-insurance, benefit limits and exclusions may apply. For all terms and conditions visit www.aspcapetinsurance.com/terms. Preventive and Wellness Care reimbursements are based on a schedule. Complete Coverage reimbursements are based on the invoice. Levels 1-4 reimbursements are based on usual and customary eligible costs. Products, schedules, and rates may vary and are subject to change. Discounts may vary and are subject to change. More information available at checkout.

Which Is The Best Pet Insurance In Massachusetts For You

Whether you live in Boston or elsewhere in Massachusetts, consider purchasing a pet insurance policy from one of these top pet insurance providers. Before purchasing a plan, think about the coverage you want and how much you can afford to spend.

For instance, we recommend Embraceto those looking for savings opportunities, butHealthy Paws may be a better fit for pet parents who want unlimited annual and lifetime coverage.

You May Like: What Breed Is A Calico Cat