Apply For Care Credit Or Something Similar

I put this as the last resort option for a couple of reasons. First, Care Credit is essentially a credit card, which means youll have to pay interest.

Second, its hard to get approved if you have bad credit. Its really a Catch-22.

You apply because you cant afford to pay for emergency treatment, but you get denied because you cant afford to pay for emergency treatment.

Still, if you have decent credit but just dont have money at the moment to cover an emergency, its worth a try.

Its really difficult to hear that you cant get pet insurance for cats with a preexisting condition when you need it most, I know.

I wish I could say, get this insurance and youll be covered, but it just doesnt work like that. Still, the above options are a good place to start for congenital issues!

My Recommendation

Its hard for me to recommend one of the above more than the others because they all bring something different to the table.

However, if you told me that the fate of the world rested on me picking one, Id go with Embrace, mainly because they cover well visits, too.

On the other hand, I do like that Trupanion pays vets directly, so you dont have to shell out money that you dont have.

Do you know of any pet insurance for cats with preexisting conditions? If so, please let us know!

Find her on . Read her latest articles.

Learn more about Nicole Here

Can Pet Insurance Cover Pre

If the pre-existing condition is curable, the answer is yes. However, if the pre-existing condition is chronic and its been diagnosed prior to the coverage date, pet insurance companies will not offer coverage. Just because you have a dog that is a specific breed and that is known to develop certain genetic conditions doesnt mean coverage wont be granted. If your pet has not been previously diagnosed when coverage kicks in, any tests or treatments of those illnesses or diseases are fully covered. Simply, those tests and treatments must occur after the date your policy takes effect.

Does My Pet Need To Be Examined Before Enrolling In A Pet Insurance Plan

Some pet insurance companies may want to see your pets medical records or proof of a full veterinary exam to check for any pre-existing conditions or health conditions before enrolling your pet.

But not all pet insurance companies have this requirement. For example, ASPCA pet insurance does not require a veterinary exam or medical records to purchase a pet insurance policy.

You May Like: Can You Put Peroxide On A Cat

Is There A Pet Insurance Plan That Covers Everything

No pet insurance plans cover pre-existing conditions, and most plans wont cover the taxes, grooming, or boarding. Aside from that, you can obtain a plan that covers just about everything else. For example, a policy with strong accident and illness coverage combined with a pet wellness plan will cover a large percentage of almost all your potential veterinary expenses.

Lifetime Pet Cover Pre

- Dental illness and injury covered

If your pet had a health problem in the past that has been completely cured for more than two years, then Lifetime Pet Cover will insure the condition on new policies. Open the Policy Wording and on page 8 you’ll find the official language regarding pre-existing conditions. The terms state that a condition will cease to be a pre-existing condition if all of the following are true:

- A condition has been treated and your pet has fully recovered, leaving no susceptibility to future problems or underlying weakness and since that point

- The condition has been treated and your pet has not received any treatment for or in connection with the condition for a continuous period of 24 calendar months

- There are no symptoms or vet consultations relating to the condition for the previous 24 months

Here’s a screenshot of the relevant section from the Policy Booklet:

Read Also: What Is My Cat’s Name

My Persian Cat Has A Little Trouble Breathing Its An Inherited Condition Is She Covered For Treatment By The Pre

It really depends on whether its an ongoing, constantly managed condition or just something youre worried will cause future issues, though shes healthy right now.

Shell need to have been free from advice, medication and treatment for three months for her to have her breathing problems covered by it.

Want To Find Out More About Our Pet Cover

Got a question about our cover for your pet? Or want to know more about cats and dogs in general? Weve answered a few questions for you here!

How does multiple dog insurance work?

If youve got more than one dog, then why not look at multi-pet insurance?

Instead of having each of your dogs on different pet policies, with our multi-pet insurance, you can save any hassle and take advantage of our multi-pet discount. You can cover up to five dogs on one policy. We are unable to insure dogs that are used for breeding purposes and pre-existing illnesses and conditions are not covered.

How does multiple cat insurance work?

If you own more than one cat, then you could look into including all of your cats on one insurance policy.

Multi-pet insurance means that you dont need to have all of your cats on different policies. Instead, you can cover up to five cats on one policy, saving you plenty of hassle and money at the same time!

We are unable to insure cats that are used for breeding purposes and pre-existing illnesses and conditions are not covered.

How does multiple cat and dog insurance work?

If youve got dogs and cats at home, then why not look at multi-pet insurance?

When can I get pet insurance?

Insurance for your cat or dog can start as soon as possible! Our cover starts for cats and dogs aged eight weeks and over. We cannot cover claims arising within the first 14 days of your insurance starting and pre-existing illnesses and conditions are not covered.

Veterinary Fees

Recommended Reading: Why Wont My Cat Drink Water

Hereditary And Congenital Conditions

Many companies cover congenital and hereditary conditions as long as your pet hasnt shown any signs or been diagnosed with one before coverage starts. Some companies even have separate hereditary and congenital coverage policies.

Hereditary conditions are common, especially in purebred animals, and are inherited from a pets parents. Some examples include:

-

Urinary blockages, crystals, or idiopathic cystitis

Can I Insure My Pet If They Have A Pre

Yes, you can still get pet insurance with us but pre-existing conditions wonât be covered by any of our cover levels. These are health issues, concerns, illnesses and injuries which you or your vet were aware of before you took out your pet policy.

The same also applies to any pre-existing conditions that your pet is no longer receiving treatment for, as we’ll always consider it to be pre-existing, no matter how long ago the issue occured. This means it won’t be ever covered throughout the entirety of your policy if you decide to insure with us.

Recommended Reading: Best Flea Treatment For Kittens

Is It Worth Getting Cat Or Dog Insurance If They Have Pre

While some pet insurance companies won’t cover pre-existing conditions and non-medical needs like holistic therapies, food, supplements, or boarding, it can still be worth it for covering future accidents and illnesses that require expensive treatment.

Example:

Your dog’s pre-existing breathing condition might not be covered by pet insurance. But if he accidentally breaks a leg while playing or develops cancer after your policy’s waiting period, dog insurance can cover those treatment costs, up to the limits of your policy.

Scratch & Patch: Best For Levels Of Cover

Specifications

Whether you can get pre-existing cover on Scratch & Patchs Champ plans really depends on the specifics of your pets medical history. The company has so far provided cover for pets with a long list of medical ailments, but youll need to fill in an online medical screening before youll be told whether your pets specific case is one theyre happy to cover. Having an extensive knowledge of your pets health before the policy begins is what the company says allows them to cover a wide range of things not cared for elsewhere.

Naturally, theres a slight penalty if you do get that cover, with paid vets fees reduced significantly on known conditions, although this generally wont affect your yearly cover limit for other treatments. Youll want to make sure you havent kept anything secret from your vet, because theres obviously going to be a little cross checking going on when it comes to paying out. Scratch & Patch may also choose to not cover all of your pets conditions. Again, its a question of specifics.

The Champ plans offer three levels of cover, ranging from £2,500 fees up to £8,000 per year, and Scratch & Patch is willing to waive the usual post-purchase waiting period on the policy provided youre transferring from another provider.

Read Also: How To Make Cat Ears Headband

How Do I Know If My Pet Has A Pre

You can contact your vet and ask to see your pets medical history. All conditions, treatments and observations will have been recorded.

If you ever need to make a claim, Animal Friends will review your pet’s medical records to assess if the recent injury or illness is related to any pre-existing condition.

What Happens If I Want To Change Insurer

If your pet has a pre-existing condition, you may find it difficult to change insurer as your new insurer may not provide cover for that particular medical issue.

Whats more, if youve claimed on an existing policy, you may find it harder to get a new pet insurance policy at a competitive price. You may therefore find it preferable to stick with your existing insurer.

Also Check: How Can You Tell If Your Cats Pregnant

Whats The Difference Between Chronic And Hereditary Conditions

Chronic conditions

These are long-term or incurable illnesses that your pet might have for their whole life. Chronic conditions include:

- asthma and urinary tract infections in cats

- glaucoma or arthritis in dogs.

Hereditary conditions

Some pets suffer from genetic issues which are sometimes passed down to your pet from their parents. These may affect pedigree animals and may even be as a result of inbreeding. It’s best to get cover before any hereditary conditions develop, like:

- elbow dysplasia

- intervertebral disc disease.

Providing that the first clincal signs of your petâs condition did not occur before you took out a policy with us, and this falls within the terms of your policy, then we may be able to cover it. Both short-term and long-term illnesses are not covered on Accident Only policies.

List Of Automatically Coveredmedical Conditions That Do Notneed To Be Declared

Acne, ADHD, Allergic reaction provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis,Arthritis , Asthma ,Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox – if completely resolved, Common cold or flu, Cuts and abrasionsthat are not self-inflicted and require no further treatment, Cystitis – provided there is no on-going treatment, Deafness, Diabetes , Diarrhoea and vomiting – if completely resolved, Eczema, Enlarged prostate – benign only, Essential tremor,Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury – provided you are not currently being treated, Macular degeneration,Menopause, Migraine – provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis – provided there is no on-going treatment,Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid , Urticaria,Varicose veins in the legs.

Don’t Miss: Kidney Cat Food Non Prescription

Pet Insurance For Pre

For cats and dogs with pre-existing conditions

A policy for pets with recent conditions that havent needed treatment, medication or advice in the last three months.

- Up to £500 cover for pre-existing conditions in the first year. Increases to £1,000 in the second year if you dont make a claim

- Plus a £7,000 overall vet fee limit for new illnesses and injuries

- All our other policies cover conditions that ended at least two years ago

What Else Is Covered

Its not just pre-existing problems that this policy covers. It also includes:

-

Up to £1,000 for complementary treatments within your £7,000 vet fee limit

-

Dental cover for accidents

-

Legal action against you and your pet

-

The option to add cover for advertising and a reward if your pet is lost or stolen

-

Saying goodbye – £150 contribution towards euthanasia, burial and cremation costs

But you wont be covered for:

-

Pre-existing injuries or illnesses that occurred in the three months before taking out the policy. Theyll only be covered once your pets been free from veterinary treatment, medication or advice for a period of at least three months

-

Accidents that happen in the first 48 hours you have the policy or illnesses that happen in the first 14 days – unless you switch to ManyPets straight from another pet insurer

-

Dental illness – if this is important to you it’s covered by our Complete policy, although that policy doesnt cover pre-existing conditions from the past two years

You May Like: Blacked Out Cat Skid Steer

Will I Be Covered Immediately

No, unless youve switched to us from another provider. Like most pet insurance policies theres a waiting period at the start. That means theres a short period of time before you can make a claim.

For all our policies the waiting period is two weeks for illnesses and 48 hours for accidents. But if you previously had cover with another pet insurance provider and you switch to us with no break in cover, theres no waiting period and youll have immediate cover.

Does Pet Insurance Cover Bilateral Conditions

A bilateral condition is an illness or injury that affects both sides of the body. A bilateral injury or illness could be pre-existing conditions but not always.

Provided all terms of the policy are met, MetLife Pet Insurance may cover bilateral conditions that are diagnosed after policy coverage begins.

Also Check: Do Kittens Need Kitten Food

Investing In Your Pet’s Future

Even if your pet has a pre-existing condition, Pet Assure provides a practical way that you can still reduce the costs of any veterinary care that he may need. There’s no hassle, there are no exclusions, and the process is far easier than dealing with pet insurance companies. You’ll receive discounts from participating vets right at the time of service, so you’ll instantly save money.

No matter what pre-existing conditions your pet may have, Pet Assure makes veterinary care more affordable so you can ensure your pet always gets the care he needs and deserves.

Compare The Best Pet Insurance Providers For Preexisting Conditions

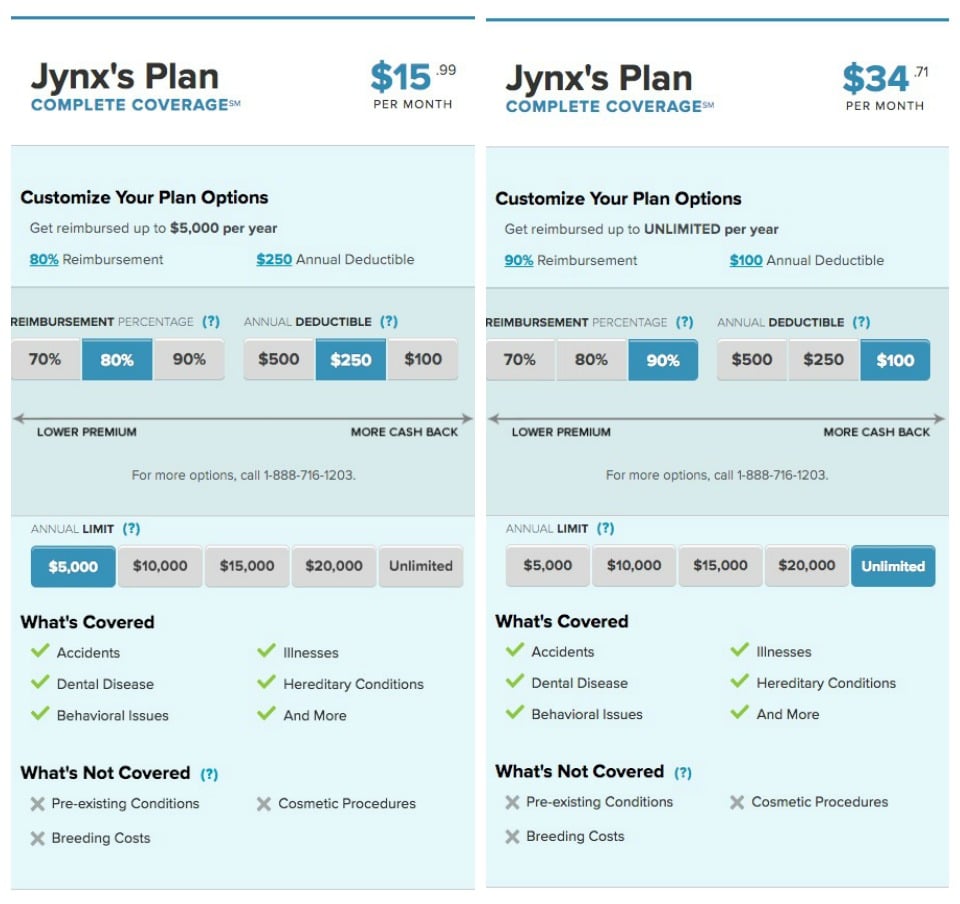

When weighing the pros and cons of each provider, keep in mind your monthly budget. If youre looking for a more affordable option, you may want to consider providers such as Spot that allow pet owners to customize their deductibles, annual limits and reimbursement rates, as these factors will directly affect monthly premiums.

Additionally, you may wish to consider providers that offer wellness coverage options, since routine care visits are an ideal way to proactively catch any developing conditions early.

Below, we compared the best pet insurance providers for preexisting conditions based on price, waiting periods and discounts.

|

Provider |

||

|---|---|---|

|

3 days for accidents 14 days for illnesses |

*Each providers monthly cost is based on accident-and-illness policy quotes we obtained for a 4-year-old, medium-size, mixed-breed dog in Raleigh, N.C.

Also Check: How Do Cats See At Night

How Much Is Pre

Not surprisingly, the average cost of pre-existing pet insurance is generally higher than the cost of regular pet insurance, with prices typically exceeding £400 a year . For example, we found that ManyPets’ Pre-Existing policy costs around 2X as much as their Regular pet insurance plan .

Of course, you may find prices are quite different for your pet, since prices can vary significantly by breed, pet age and even where you live. Be sure to compare quotes from different companies to understand market pricing for your particular situation before deciding which is most suitable and economical for you.

The following analysis of ManyPets’ pricing shows how the cost of pre-existing pet insurance compares to pet insurance that does not cover pre-existing conditions. For this exercise, we used a £99 excess across all policies because the Pre-Existing plan only has the £99 excess option. Here’s how quotes compared:

Pets who have been healthy for over two years will have a wider range of coverages available to them , and at cheaper prices.

How Does The Pre

Our Pre-existing policy is designed to give you some cover for conditions that your pets had in the past two years, as well as for any new conditions your pet develops:

-

Theres a £7,000 limit for new and recurring conditions that start after you take out the policy. This limit resets every time you renew your policy.

-

You have a £500 limit for vet fees for all pre-existing conditions in the first year you have the policy, as long as theyve had no advice or treatment in three months before you buy your Pre-existing policy.

-

That limit increases to £1,000 in the second year if you dont claim for pre-existing conditions.

-

If, after two years, you havent needed to claim for a pre-existing condition it will not longer be classed as pre-existing and you can use the full £7,000 vet fee limit in future if you need to.

Read Also: Revolution Plus For Cats Sizes

Choosing The Most Appropriate Insurance For A Pet With Pre

If your pet already has a pre-existing ailment, you can still get pet insurance, and the insurance will cover conditions that are not related to the pre-existing disease.

Things to keep in mind are as follows:

- Be a pet owner who takes an active role

Taking care of the injury or illness as soon as possible prevents the situation from worsening and resulting in enormous vet expenditures. Taking the necessary safeguards will help avoid future mishaps or diseases from occurring due to the condition.

- Keep your pets vaccines up to date at all times

Your cat becoming unwell due to your inability to keep them up to date with their immunizations is the absolute last thing you want to happen. Many insurance companies will deny a claim if your pet falls sick due to not having been vaccinated following your veterinarians recommendations.

- Compare cat insurance

- Purchase pet insurance as soon as possible

Pet owners who have pre-existing ailments should be aware of the financial burden that vet bills can place on their finances. The expense of future treatment for the same condition can be reduced if pet insurance coverage is purchased early on in the relationship.

- Alternatives to pet insurance should be considered

Companies such as Eusoh< and Pawp provide alternatives to insurance that help cover the costs of a pets medical expenditures in an emergency.